|

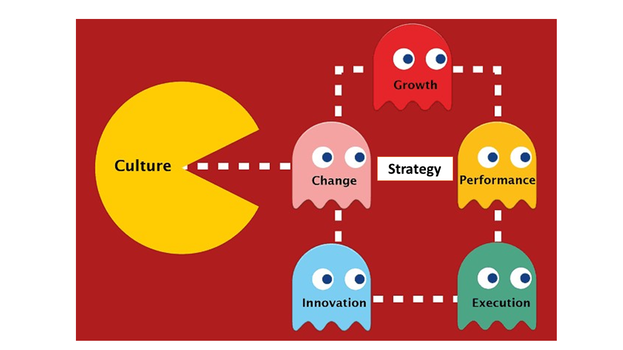

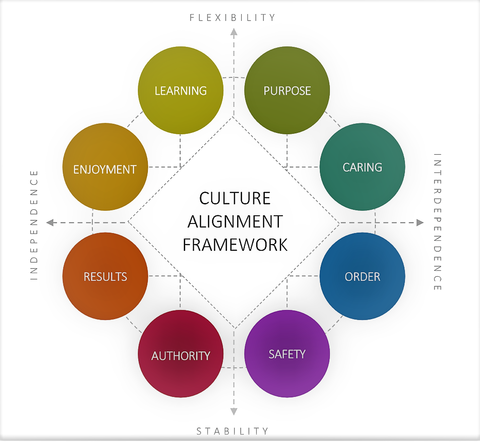

By Rocio Summers In October 2017, the National Association of Corporate Directors (NACD) published its Blue Ribbon Commission’s Report on Culture as a Corporate Asset. The Wall Street Journal's headlines read: “After Uber and Wells Fargo, Boards wake up to Company Culture”. The NACD precisely emphasized that even though organizational culture has been studied in business and academic writers for decades, “it tends to attract public attention mainly in the wake of negative events (…) but if led and managed well, culture is the rocket fuel for delivering value to stakeholders”. So what is culture, why is it so important and why is everybody speaking about culture, including myself in my prior articles? (see “Doing business internationally. Expanding widely” and “M&A: A marriage of convenience”). The NACD Blue Ribbon report defines culture as a “series of assumptions individuals make about the groups in which they participate, visible through public statements, stated goals and basic (taken for granted) beliefs”. The famous saying “Culture eats strategy for breakfast” attributed to Peter Drucker, reflects in a very graphic way the relationship between culture and strategy. Drucker certainly believed that a company's culture normally thwarts any attempt to create or enforce a strategy that is incompatible with that culture. It’s not trivial, therefore, that Directors are including culture among their priorities in governance practice, as there is no way the best strategy can succeed if there is not an alignment with the culture of the organization. And this means that this alignment is critical and at the same time extremely difficult to evaluate. And precisely because culture is hard to measure, it is frequently ignored or approached in a merely intuitive manner leading that way to many failures and disappointments. Among the business literature, I particularly like Spencer Stuart approach to measuring culture. Harvard Business Review dedicates an extensive article in the Jan-Feb 2018 issue to explain this methodology. Basically, the model maps culture styles along two dimensions: how people interact: independence vs interdependence and their resistance to change: flexibility vs stability. Based on this, 8 different culture styles are defined. The distance between styles is important as proximate styles will coexist more easily (purpose and caring) than distant ones (learning and safety). Spencer Stuart has developed a methodology to evaluate individual’s responses in particular cases and define their preferred relative order in culture: The individual style profile. At the same time, we can define where the organization culture sets through public statements, general behaviors, and employees perception of company's values. This simple methodology can help us visualize very clearly, whether the Executive Leadership of an organization or the Board of Directors is aligned with the culture and whether the organizational culture is consistent with the Strategy. The lack of alignment is also the struggle of most mergers and acquisitions. When Amazon acquired Whole Foods last summer, there were plenty of questions in the markets about the success of this union - In Spencer Stuart’s chart, Amazon was classified as Authority style while Whole Foods fell into the Purpose category- Even though the financial results seem to be good so far, there are still serious concerns about the lack of compatibility of cultures. Miami Herald just published an article titled: "I wake up ... from nightmares:’ Why Whole Foods workers are hating life". www.miamiherald.com/news/business/article198441939.html As culture is fed by human beings, it is obviously subject to evolution. And this happens sometimes spontaneously when a company grows and expands geographically or expands its workforce intergenerationally. The role of the leadership and the governance, in this case, must be to safeguard the values and mission of the organization. But what happens when change is necessary? And why would the change be necessary? There could be external or internal factors that would make it advisable to change an organization strategy. In an extremely fast and disruptive world, ultimately no industry can afford remaining status quo and survive. In this context, the very stable organizational cultures, predominantly Authority or Safety styles, have more problems to adapt to the necessary changes, and when the strategy needs to change, they are much more vulnerable. Other external factors can also pose a threat to Purpose and Caring organizations such as nonprofits, and force them to turn to a style more oriented to Results or even Authority. So how should organizations deal with the necessary change and Change Management? There’s extensive business literature on this subject. Let’s just focus on a couple of critical points: · Define precisely what the strategic changes need to be. As with everything in strategy, it is a question of trade-offs. Priorities need to be defined. What is an immediate threat, where can a significant competitive advantage be obtained and what is doable considering the organization’s leadership capabilities and culture? Whether the strategy change means going global, reorienting the strategy to be more customer focused, introducing or prioritizing innovation, promoting sustainability or betting for nimbleness and cost reduction, organizations should choose one of the changes and focus on it. · Evaluate leadership’s alignment with the necessary change. The organization may or may not have the appropriate leader to achieve the transformation. It will need to evaluate if the organization’s culture is ready to face this change and whether the leadership is strong enough to “steer the boat”. Obviously, the Board needs to be aligned with the needed change and oversee and evaluate the adequacy of the current leadership. It may easily be the case that the strategy change requires a change in leadership and that’s by definition one of the main functions of a Board: hiring and firing the CEO. · Finally, communication is key. It is necessary to enable a well-dimensioned team to cheer the change, design the execution and put it in place, and send a clear and structured message to the employees. That will facilitate that employees “buy-in” and the morale of the organization doesn’t suffer so much. Make it a purpose to engage employees in conversations about the cultural changes, the new goals, and the desired objectives. Organize structured group discussions and social media platforms. That way, the inevitable discussions will happen in a healthier manner. Change is never easy and needs to be approached carefully. However, it has been said that change is the only constant. The main challenge with change is precisely how embedded culture is in the people that form the organization and how it is related to their values and principles. When an organization decides to undertake a major cultural change, it needs to assume from the very beginning that it may lose some talent on the way, just because of the lack of fit with the desired transformation. It's up to the organizations and their governing bodies to find leaders able to lead the change and adjust the culture to the new strategy. Most times the process is painful, but neglecting or ignoring the need to adjust the culture to the strategy, can be fatal.

1 Comment

By Rocio Summers  In 2011, Frits Van Paasschen, at the time President and CEO of Starwood Hotels and Resorts moved himself and his whole senior leadership team to China for a month. When he was asked the reason behind it, he explained that in the past, when he had run business overseas and brought people from the Head Office for a week to show them the operations, the picture was never complete. As Starwood was establishing a new business in China, he felt if he could move there for a whole year he would learn so much, but that didn’t seem to be practical for the CEO of the company. It was his wife who suggested he went for a month. Then he decided that he would go with his team to show them the importance of markets outside of the home office and how being a global company meant to have a global mindset in which people understood the international markets as part of the whole project. He wanted his team to experience the specific peculiarities of this new operation and come out with ideas. He expected them to have downtime to buy groceries and observe people, feel their needs and expectations. In other words, he wanted his team to understand the culture in China, the market dynamics and the reasons behind it. In the last decades, we have seen corporations strategizing around international expansion and diversification, growing in new markets, exploring emerging economies and establishing operations in remote geographies and different cultures. Most of the time, these adventures have served them well and they have been able to increase their demand and grow their business exponentially. But in some other cases, the unforeseen problems and complications associated with the new venture have turned the dream into a nightmare, the costs have exceeded by far the initial projections and the break-even has arrived much later than expected, making the project much less attractive from an economic and strategic point of view. Of course, not everybody can afford to transfer the whole executive team for a month to a remote geography, among other reasons, because not everybody owns a hotel in those geographies, but there are a lot of things that can and should be considered before expanding internationally, before becoming global. As in my prior posts, the very first question I would ask the Board of Directors of an organization expanding operations in different countries is “Why”. How is this choice consistent with the mission and long-term vision of the organization? But I would also ask “Why not”! “There’s a big world out there” and as someone said once “I don’t think that there is any one idea that won’t work somewhere”. Establishing operations abroad has some obvious advantages:

Obviously, before any sensible group of leaders starts such a significant project, they should do their due diligence and this needs to cover different perspectives.

This is not the only study about different cultures. What is shocking is that around a 70% of the international transactions fail because of cultural mismatches and yet, most of the organizations ignore the importance of the cultural issues and tend to think that the principles and values that are valid at home are universal and the only valid ones. This is the first mindset that needs to be changed before going international, and then go backward and analyze the rest. In my experience, most of the business and organizations check the boxes above more or less in the order I have enunciated them, and even though they spend a lot of time and resources evaluating the market, the supply chain and the regulations, they tend to ignore socio-political and geostrategic environment of the country they are moving in and the cultural differences. This could be a consequence of a simplistic mindset or even worse, an arrogant one, but whatever the reason for this procrastination is, the reality is that it will be a recipe for failure. If you’re aiming for an international strategy, pay attention to the culture and behavior of the people in the market you are moving to. Because those are now your stakeholders. At RSIBC our passion is helping organizations develop their business and operations globally and we partner with experts in different fields to provide the best service and advice in different regions of the world. By Rocio Summers Last month I wrote about the instinct for growth that all human beings share. It looks like at a certain point in their lives, most of them also feel the impulse of finding a partner and eventually get married. Some, even more than once! But in the case of enterprises, this is clearly a marriage of convenience. And the very remarkable goal is to achieve something bigger together than the sum of the parts.

In his beautiful book, "The Wisdom of Finance", professor Mihir Desai, dedicates a full chapter to Mergers and Acquisitions titled: “No romance without finance”. With his characteristic fine humor, Mihir takes us in a trip around Hollywood movies (Working Girl), jazz music (Charlie Parker and his band playing “romance without finance”) to the Renaissance Italy of the Medici and their arranged coupling practices. He finally makes us land on some examples of disastrous mergers: AOL and Time Warner in 2000 and some others more successful like General Motors and Fisher Body in the 1920s. Again, in a humorous manner, he describes the last one as the transition from flirtation, arrangement, the need of a deeper commitment and finally marriage and love. After all these fun stories, we know what the lesson is: synergies are often overstated, and the costs of integration are typically understated. Another great professor at Harvard Business School, Felix Oberholzer-Gee used to repeat in his Corporate Strategy lessons, the 3 tests any merger needed to pass before deciding to go ahead:

1. The value test. This test refers to the rule of thumb that One plus One must equal Three in order to proceed with the “marriage". When looking for the right partner, we need to really be looking for these synergies with a realistic approach. Sometimes the synergies may refer to costs savings due to supply chain efficiencies, shared information technology, improved sales and marketing, R&D, patents, reduction of overhead, etc. Sometimes, they may come through a revenue upside: complementary products that can be bundled or complementary geographies and customers, allowing the merged firm to access a broader demographic and producing higher revenue. Even though sometimes some of these synergies may seem clear, effective integration is key to make them happen in an efficient manner. 2. The ownership test. Continuing with the parallelism with marriages, this test would be like questioning whether a marriage is needed versus remaining “friends with benefits”. It really is prudent to consider whether a strategic alliance or a good agreement is a better solution than a merger and integration. Why? Just because the costs of integrating can be huge and the benefits not as obvious as expected at first. 3. The organization test or the cultural fit. To me, the cultural fit is probably the most important. Organizations are living entities full of people. Ignoring culture is a big mistake that will lead to the most catastrophic results in business. And as culture is a significant part of the strategy, it needs to be taken into account when precisely we are taking the most strategic decision for our business. Inorganic growth through M&A is an excellent way to consider expansion and achieving great things. But it needs to be done with caution. There are three major keys to success:

For each of these steps, there are experts in the field that will help you achieve your goals. Count on them and plan it well because the risk you are running is too big to be left to good luck. At RSIBC, we partner with the best in class experts to guide you through the whole process of M&A in a seamless and painless way. by Rocio Summers Growth is a natural instinct in human beings. We are meant to grow since we are born until we reach maturity. And even way after our bodies are fully developed, we want to keep growing as persons, as professionals, keep learning, keep understanding and increasing our wisdom until we die. In business and organizations, I see the appetite for growth as a common factor. No matter how big or small the organization is, no matter whether it is a not for profit or a big global company, no matter whether private or publicly traded. All of them have growth among their goals, in a written or not strategy. And this is precisely also the main frustration in organizations and the main failure: not achieving the level of growth they had planned. However, sometimes, growing too fast is extremely dangerous. Let's go step by step. Why growth? The first question I would ask is why growth. Don’t say no to growth, but first ask yourself why you want to grow, how, where and what for? All these questions seem obvious, and precisely because of that sometimes they get unanswered and lead to wrong actions. At the end of the day, what we are questioning is what our strategy is and how our actions are leading us to achieve the mission of the organization. Invariably, in order to achieve our goals we need to be solvent, and intuitively we tend to think that bigger is better, but before we try to achieve our goals we should really need to consider how big we want to be, how we want to get there and what the risks are. How big do we want to be - and is it realistic? I read yesterday and article in HBR about how to establish realistic goals. It explained a methodology combining the timing factor, that dismantled the linear projections of a business and cautioned us: beware of the spreadsheets. In the example, the writer recalculated with the company's own assumptions, a 5-year projection, that went from $640M to $180M in revenue. Significant gap that unfortunately happens too often in long term plans. In its conclusion the author stated: "Take the time to assess what your growth gap potential is. It’s all too easy to assume that your current business will deliver the growth that your investors, employees, and other stakeholders are expecting. The process is not that complex: Simply look at the growth trends of your existing lines of business and compare them to where you think your strategy needs to be at some point in the future. Usually, there will be a gap. While it seems astonishing that leaders wouldn’t do this (and boards wouldn’t insist on it), we see it all the time. Sometimes, it is because leaders just won’t take the time away from day-to-day operations. Sometimes, it is because, oddly, it is no one’s job. And sometimes, there are simply too few people with the vantage point to see the trends across the entire enterprise. And unfortunately, executives in some companies are rewarded for essentially gaming their numbers rather than being realistic". How are we going to get there? And what are the risks? From a financial point of view, no matter what the chosen way to grow is, the main risks are always the same: profitability and cash flow. Too many times, there is a temptation to drop prices in order to achieve volume. We overstate the power of loss leaders, and inflate our projections (as in the example above) and very soon we find our gross margin decrease and our EBITDA become unhealthy. We are scarifying profitability in favor of volume and we are forgetting that solvency was part of the equation. And speaking of solvency, what about that paradox that the more we sell, the less money we have? Listen to your CFO and manage your working capital. Otherwise, that invisible investment will absorb all your resources, and you'll find yourself struggling to get the funds you need to move on. Go lean on inventory, look for quality sales, that are profitable and with clients that respect your credit and collections policy, manage your suppliers and again, don't establish unreasonable goals. If the nature of your business makes it intense in working capital, look for tools to finance it, and take the cost into consideration in your growth evaluation. Finally, most of the time, though, the main risk is related with culture. In his book, "The founders’ mentality", Chris Zook defines the paradox of growth. Growth creates complexity and complexity is the silent killer of growth. Chris leads us again to Steve Jobs' premise of simplicity as the way to succeed. And gives us other examples like Facebook (vs. myspace), amazon, the eternal startup, or Michael Dell bringing the company back to private in order to keep it close to its core and loyal to its strategy. Whether you choose international growth, diversification of your portfolio, looking for a new partner or IPO, establishing strategic alliances or even M&A, be ready to work deeply and seriously in how this affects your culture and your core business. Stick to your mission and values. Embrace diversity and understand it. Understand the dynamics of the market where you decide to be in. Be ready for the challenges, keep a clear mind of why you want to do it, and where you want to arrive. Analyze it with a challenging point of view. And then, if it still makes sense, go for it, do it, because at the end of the day, growth is evolution and the process is fascinating. |

Archives

February 2018

Categories |

RSS Feed

RSS Feed